Informe de análisis de datos del mercado de automóviles importados de China

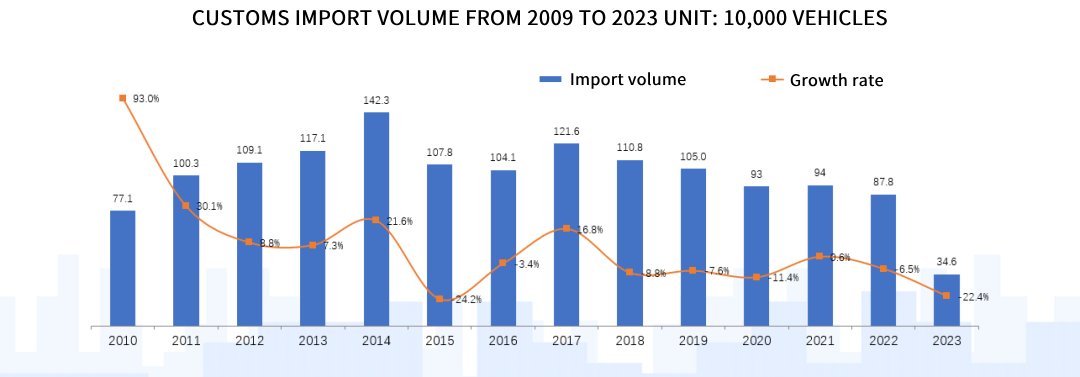

Volumen de importación de aduanas:

(1) Suministrar: Después de tres años de declive, Las importaciones de automóviles disminuirán ligeramente en 2022 y acelerar en 2023, entrando en el período de “desorden”.

De enero a junio, 346,000 Se importaron vehículos, una disminución de 22.4%; el valor de importación alcanzado 150.07 mil millones de yuanes, una disminución interanual de 17.5%. En junio, 63,000 Se importaron vehículos,

un aumento de 8.6% interanual.

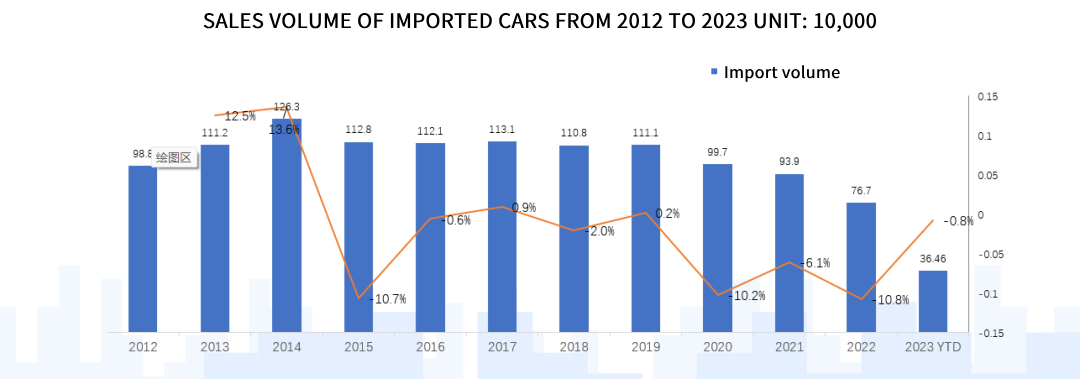

Venta de autos importados:

(2) Demanda: En los últimos años, La demanda terminal de automóviles importados se ha mantenido relativamente estable..

El mercado de automóviles importados ha caído, con unas ventas acumuladas de 364,600 vehículos de enero a junio 2023, una ligera disminución de 0.8% interanual.

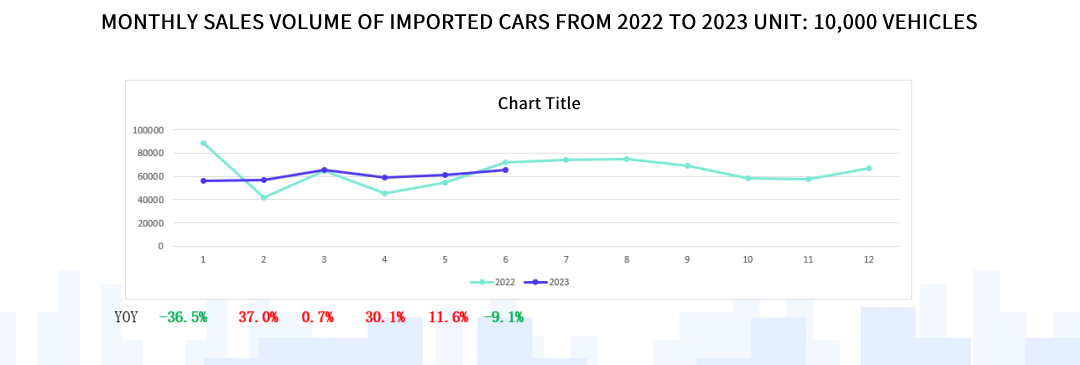

(2) Demanda: A juzgar por la tendencia de ventas mensuales de automóviles importados de 2022 Para 2023, el mercado muestra signos de recuperación, con ventas promedio de febrero a abril

Crecimiento alcanzado, el alto crecimiento en febrero se debió al factor del Festival de Primavera, el alto crecimiento en abril y mayo se debió a la baja base del año pasado, y junio se vio afectado por la base alta del año pasado

Hay una decadencia.

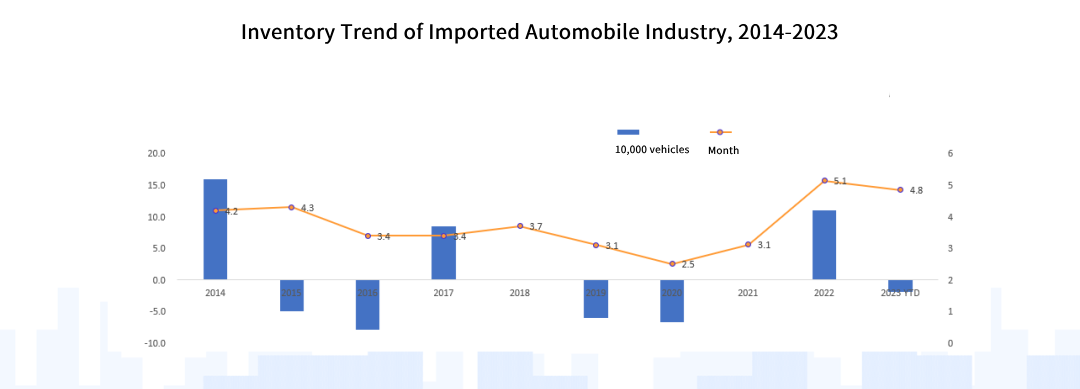

En stock

(3) Inventario: El comienzo de 2023 entrará en el ciclo de reducción de existencias como se esperaba, La oferta de automóviles importados de enero a junio será menor que la demanda., y la cantidad absoluta de inventario disminuirá

En comparación con el final de 2022, la profundidad del inventario ha disminuido ligeramente a 4.8 Meses, que todavía está en un alto nivel.

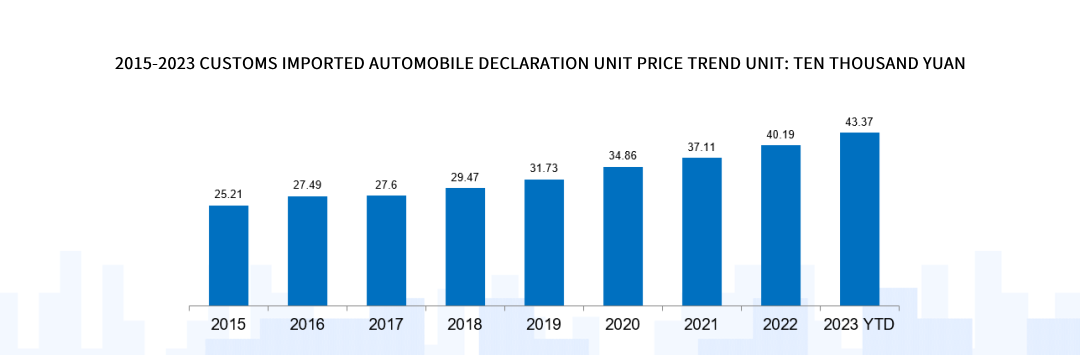

Precio de Aduana

(4) Precio: El precio unitario de los automóviles importados ha aumentado año tras año. De 2015 Para 2023, El precio unitario de los automóviles importados aumentará de 252,100 yuan.

El ascenso a 433,700 El yuan se debe a la tendencia de mejora del consumo., la tendencia de localización de productos de bajo precio, y la reciente depreciación del tipo de cambio.

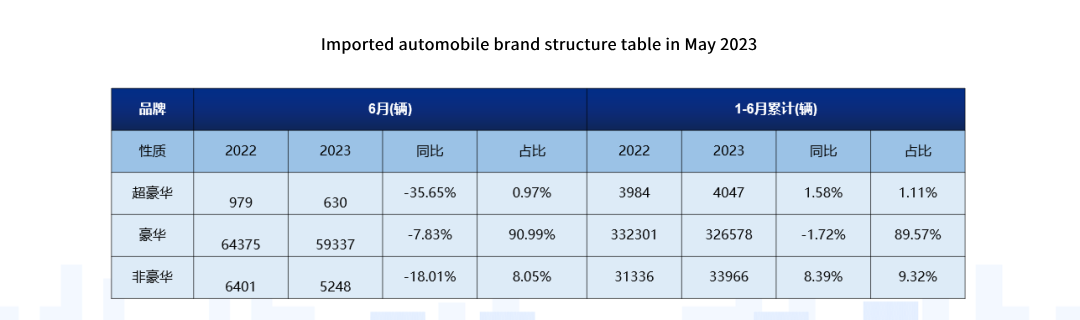

Estructura de marca

(5) Estructura de marca: El mercado general de automóviles importados mostró signos de debilidad este mes, y las ventas de coches de ultralujo cayeron 35.65% año tras año este mes.

De enero a junio, El incremento interanual acumulado aumentó ligeramente en 1.58%. También cayeron las ventas de coches no de lujo 18.01% año tras año para el mes. Los coches de lujo siguen siendo la principal fuerza de ventas, 6

Las ventas mensuales cayeron 7.83% interanual, y la proporción acumulada de enero a junio fue 89.57%.

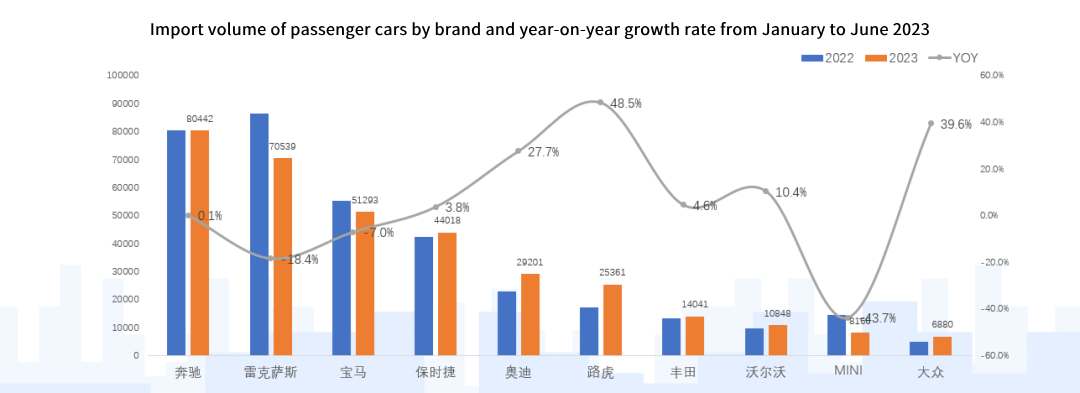

(6)Distribución de marca: De enero a junio 2023, siete de las diez mejores marcas (Mercedes-Benz, Porsche, Audi, Rodante, Toyota, Volvo, Volkswagen) todo

esta creciendo ahora; Mercedes-Benz, que ocupa el primer lugar, vendido 80,442 unidades, Un aumento de 0.1% interanual, y las ventas de BMW y MINI cayeron debido a los modelos nacionales.

Corredizo 7% y 43.7%, las débiles ventas del modelo principal de la serie ES arrastraron a Lexus hacia abajo 18.4%.

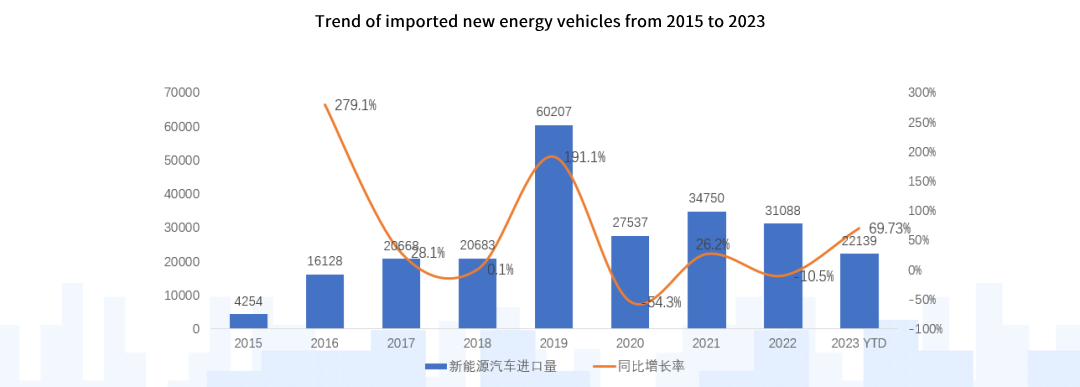

(7) Fluctuaciones en las ventas de productos importados nuevos vehículos de energía: De enero a junio 2023, Se alcanzaron las ventas de vehículos de nuevas energías. 16,725 unidades, un aumento interanual de 69.73%. híbrido enchufable y puro

Ambos vehículos eléctricos mantuvieron una tendencia de rápido crecimiento, con un crecimiento interanual de 25% y 151% respectivamente. Porsche Cayenne entre los híbridos enchufables necesita Texas RX y Volvo

Volvo XC90 tiene un gran aumento: entre los modelos puramente eléctricos, Porsche Tavcán, Modelo TeslaX, BMW i-series y Lexus RZ son los que más han contribuido al aumento.

Auto en China

Auto en China