Знакомство

Тем Сяоми Ю7 продал 200,000 единицы всего за три минуты. Тем Тесла Модель Y незаметно поднял цену на 10,000 RMB через неделю - при добавлении при добавлении 31 км дальности. Около 2025, тем 200,000 Рынок умных внедорожников в юанях больше не ограничивается технологиями; это настоящее поле маркетинговой битвы, ценовая стратегия, вычислительная мощность, и восприятие бренда.

Прямо в центре этого столкновения, Xpeng G7 сделал смелый выход. С потрясающей стартовой ценой 139,900 юаней и массивный 2,250 ТОПЫ вычислительных мощностей, это нарушило тщательно сбалансированный рынок. От «специалиста» до «разрушителя цен»,«Xpeng не возвращается — он начинает прорыв, понять суть того, чего действительно хотят покупатели: высокая производительность, агрессивное ценообразование, и бренд, который излучает хладнокровную уверенность.

Трехстороннее противостояние назначено, но G7 существует не только для того, чтобы выжить — она здесь для того, чтобы переписать правила игры..

1.технологический козырь

Архитектура Xpeng G7 с напряжением 800 В — это не просто скачок в технических характеристиках — это систематический прорыв в четырехмерной игре производительность, эффективность, опыт, и стоимость.

В то время, когда отрасль все еще взвешивает плюсы и минусы между системами на 400 В и 800 В., G7 берет на себя инициативу с реальными результатами: 300 км заряда всего за 12 протокол, доказывая, что сверхбыстрая зарядка 5C — это уже не лабораторная концепция, а масштабная реальность. Свой 80.8 Аккумуляторная батарея кВтч обеспечивает 702 км рейтинга CLTC, потребляя только 12.3 кВт/ч на 100 км-только 0.1 кВтч больше, чем у полноприводной модели Y — эффективное достижение удвоенная эффективность быстрой зарядки. Это результат скоординированной оптимизации технологий и инженерии., подтверждение инвестиций в высоковольтную платформу.

В основе, инновация заключается в системный ремонт «трехэлектрической» системы. G7 использует Карбид кремния (карбид кремния) силовые модули, повышение эффективности двигателя до 97.5%, a 2.3% улучшение по сравнению с моделью Y, отражающий сдвиг в сторону «вычислительный двигатель» электромобилей.

На стороне управления аккумулятором, В Алгоритм терморегулирования на основе искусственного интеллекта сохраняет дальность на уровне 85% при -20°C на морозе, a 15% улучшение по сравнению с предыдущим поколением, что делает его одним из немногих отечественных электромобилей, действительно способных работать в экстремально холодных условиях..

Но под этим, практические реалии остаются: с Совместимость с зарядными устройствами сторонних производителей всего за 78% и 800Инфраструктура V все еще ограничена, Xpeng все равно придется полагаться на собственные силы сеть наддува в краткосрочной перспективе, чтобы устранить разрыв в пользовательском опыте.

(Источник изображения: Презентация автомобиля Xpeng G7)

Если электропривод представляет собой грубая сила, тогда вычислительная мощность — это цель XPeng G7. «разумное доминирование». Он оснащен три чипа Тьюринга собственной разработки: два предназначены для полнодоменной автономной системы вождения XNGP, и один в паре с Qualcomm 8295P для создания интеллектуальной кабины. Этот «вычислительное разделение» между кабиной и автономным вождением обеспечивает избыточность, избегая перегрузки обработки.

Реальные испытания показывают, что Ответ на голосовую команду просто 700 РС, около в три раза быстрее, чем основная отрасль отрасли. Из общего числа автомобилей 2,250 Вычислительная мощность TOPS, над 1,500 TOPS предназначены для лидарной обработки облаков точек в реальном времени., создание G7 единственный серийный автомобиль, способный «визуально + Lidar Fusion» для всепогодной эксплуатации. Однако, это обходится дорого: система восприятия потребляет 45 W, 1.8 раз Тесла HW4.0, вынудить XPeng перепроектировать систему терморегулирования, при этом жертвуя пространством в переднем багажнике.

Со стороны пользовательского опыта, XPeng подчеркивает «составная мягкая ценность». Например, тем AR-HUD имеет 13.2-дюймовая площадь проекции, 2.4 раз больше, чем традиционные HUD, отображение семь типов информации— навигация, АДАС, скорость, и т. д. — на виртуальном расстоянии 7.5 Метров, создание обзор вождения с низким уровнем помех. Но при сильном солнечном свете, Яркость HUD падает 30%, выявление ограничений текущего оптического оборудования в экстремальных условиях на открытом воздухе.

Тем XmartOS 5.0, на базе 8295P, значительно улучшает голосовое взаимодействие, Достижение 98.7% уровень признания, почти без ошибок. Но в шумной обстановке, задержка возрастает до 300 РС, показывая, что производительность все еще имеет возможности для улучшения.

Настройка шасси — еще одна область, в которой G7 выделяется.. Его сочетание гидравлические втулки + 200 м дорога предварительный просмотр предпочитает комфорт экстремальной управляемости. По сравнению с алюминиевой подвеской модели Y, разработанной для максимальной маневренности., G7 уменьшает движение тела за счет 40% над лежачими полицейскими на 60 км/ч, но показывает 2.3° больший крен кузова в скоростных поворотах. Этот инженерный подход «мягкий вместо жесткого» подходит для семейного вождения, пожертвовав некоторыми агрессивными характеристиками вождения. G7 не пытается быть абсолютным чемпионом – она стремится точно решать болевые точки основных пользователей.

В комфорте, XPeng продолжает свою стратегия «сначала сценарий». Места G7 используют трехслойная пена, мерный 50% мягче, чем Mercedes E-Class, хотя это происходит за счет боковой поддержки, отражающий четкую философия семейного дизайна.

Xpeng G7 интерьер

«Большая семерка» достигает ШВХ (шум, вибрация, и резкость) уровни просто 64 дБ в 120 км/ч, 2 дБ ниже, чем у модели Y, Спасибо более толстое лобовое стекло и 32 оптимизация акустического пакета. Однако, для экономии веса и контроля затрат, XPeng убрали безрамные двери. Это упущение вызвало споры среди молодых покупателей, которые ценят эстетику и изысканность., подчеркивая текущие компромисс между опытом и экономией.

Глядя на общий технический состав, XPeng G7 следует «ограниченное нарушение + инженерный компромисс» стратегия: оно вкладывает значительные средства в основные компетенции в области новой энергетики например трехэлектрическая система, интеллектуальная кабина, и восприятие автономного вождения – с целью обогнать конкурентов в ключевых областях. Тем не менее, в общее проектирование, проектировать, и структура затрат, оно намеренно ограничивает избегать прямой масштабной конкуренции с Tesla и BYD.

Этот подход представляет собой «технологическая ценность» средний путь: он не стремится к экстремальному набору функций и не участвует в агрессивных ценовых войнах.. Вопрос, однако, может ли это вызвать сильную эмоциональную привязанность к бренду и продукту. Когда Xiaomi привлекает молодых покупателей непревзойденным соотношением цены и качества, и Tesla привлекает высококлассных клиентов благодаря престижу своего бренда., G7 технологический козырь должен быть достаточно запоминающимся, чтобы определить его прорывной потенциал.

2.Точное ценообразование

Тем стартовая цена 195,800 Юань это не просто тактика XPeng «снижение цены за объем»., Но тщательно рассчитанная ценовая игра, ориентированная на восприятие потребителей.

G7 использует стратегия «дифференцированного ценообразования» точно использовать «слепые зоны» конкурентов: тем Модель начального уровня Pro. есть 53,900 Юаней дешевле, чем Tesla Model Y RWD, при добавлении сиденья с вентиляцией и массажем, а также система Dynaudio с 20 динамиками-а 26% Сниженная цена с обновленные функции.

Тем Версия Long-Range Max, объединение 800Высоковольтная платформа V с 702 Дальность полета в км, ловко занимает место между стандартной линейкой модели Y (545 км) и дальний радиус действия (688 км), с использованием технологические преимущества, создающие дефицит продукции.

Тем Ультра топовая версия, по цене 225,800 Юань , стратегически вписывается в ценовой разрыв между Xiaomi YU7 Pro (215,900 Юань ) и Макс версия (235,900 Юань ), переосмысление эталон стоимости для 300,000 Умные внедорожники RMB всего лишь с 10,000 Юань разница.

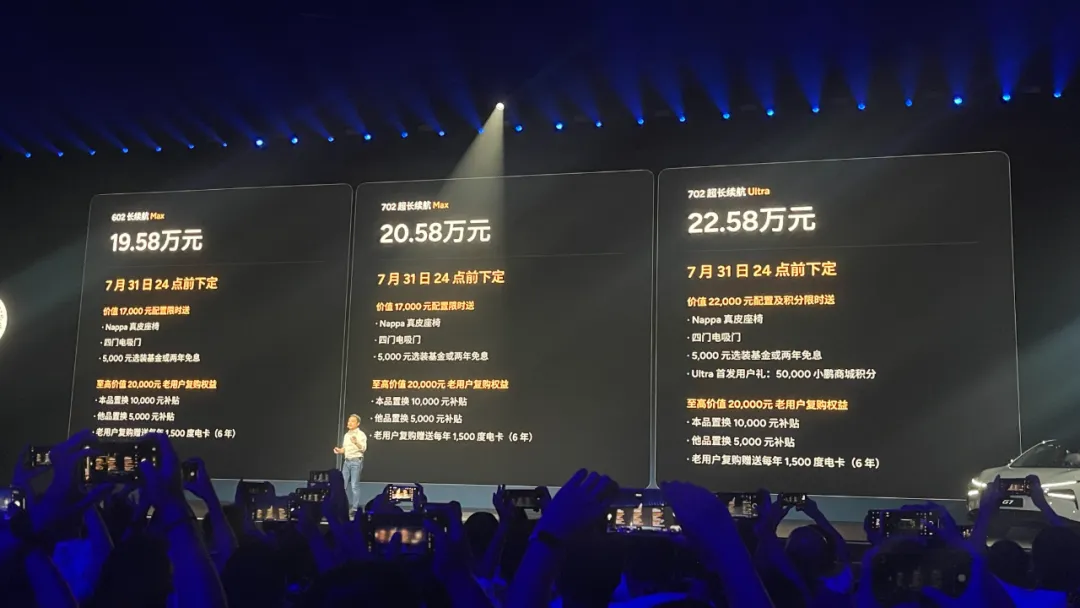

Цена Xpeng G7

Этот эффект «ножницы цены» оказывается чрезвычайно эффективным в реальных сравнениях. В то время как Tesla Model Y AWD Long Range также предлагает 688 км, его цена достигает 313,900 юань, создание 88,100 разрыв в юанях по сравнению с G7 Ultra, что эквивалентно премия 128 юаней за километр пробега.

В то же время, тем Xpeng G7 Предлагает 12 Дополнительные возможности по той же цене по сравнению с Моделью Y, включая AR-HUD, Обогрев задних сидений, и система ароматизации, в то время как FSD Теслы (Полное самостоятельное вождение) требует доп. 64,000 юань вариант, что еще больше снижает его ценовую конкурентоспособность.. Этот «высокие характеристики, стратегия низких цен стремится переопределить потолок стоимости интеллектуальных электромобилей среднего и высокого класса.

Более глубокая дифференциация проявляется в возможности автономного вождения. Tesla FSD в Китае все еще страдает от фантомное торможение (0.8 ложные срабатывания за 100 км) и смещение полосы движения вправо (15 см отклонения от полосы движения), тогда как Xpeng XNGP шоссе NGP видит процент отказов снижается до 0.3 за 1,000 км и показатели успешной смены полосы движения в городе достигают 92%.

Xpeng's перспективная компоновка оборудования, например, обещание версии Ultra о будущих обновлениях OTA, поддерживающих Большие модели VLA/VLM, останки еще не жив, создавая некоторое беспокойство пользователей по поводу «Продажи на основе фьючерсов». Этот подход—обеспечение технологического превосходства для связывания пользователей- несет в себе как возможности, так и риск.

Даже космический дизайн демонстрирует осторожную стратегическую игру. Около расширение тела 134 миллиметр, «Большая семерка» получает 819 л объема заднего багажника, 89 L больше, чем у модели Y, но жертвует 35 L передний багажник. Xpeng - это ставка на модели семейного использования— исследовательские шоу Пользователи семей после 95-го года используют задний багажник 17 раз чаще, чем спереди— однако некоторые критики сомневаются в том, что «Космический волшебник» стал «космическим расточителем».

Битва на стоимостная сторона одинаково точен. Использование «План Нирваны,» Xpeng сократила количество литых деталей кузова с 171 Кому 67, снижение производственных затрат за счет 12,000 юань, и заменил модули IGBT на карбид кремния (Карбид кремния) модули, сокращение материальных затрат на систему электропривода за счет 15%. В результате, даже несмотря на то, что G7 134 мм длиннее, чем у P7, его стартовая цена остается 24,000 юань ниже.

Однако, поддерживать 20% валовая прибыль, Шпэн повернулся к инженерные пластмассы для дверных ручек и внутренней отделки — критикуется как сокращение материала, что несколько притупляет ощущение премиальности.

Отзывы рынка подчеркивают «сладкие зоны» и «слепые зоны» этой ценовой тактики: в первый день предпродажи, 23,000 Заказы были обеспечены, С помощью метода Ультра верхняя отделка с учетом 70%, что указывает на сильное потребительское предпочтение передовые системы автономного вождения. Напротив, тем Учитывалась только входная комплектация Pro 15%, показывая, что его преимущество с низкими характеристиками с трудом создает сильную воспринимаемую ценность. Более значительная потенциальная угроза исходит от перекрытие цен Xiaomi YU7, который накопил 289,000 Заказы, 17% из собственной пользовательской базы Xpeng, предполагая, что ценовая война может незаметно превратиться в битва за потребление пула пользователей.

В этом молчаливое поле боя, Ценовая стратегия Xpeng напоминает психологическую игру, попытка преодолеть барьеры бренда с помощью конфигурации и завоевать доверие в будущем за счет предоставления технологий..

И все же окончательный ценовая власть есть не написано в брошюрах-это запечатлен в развивающемся восприятии ценностей самих пользователей.

3.Конечный ров

Когда Июньские поставки превысили 34,611 Единиц, Xpeng's загрузка мощностей приблизилась к критической 95% порог. Тем Производство G7 в первый месяц было ограничено на уровне 8,000 Единиц— внешне консервативный, но на самом деле, это послужило экстремальное стресс-тестирование возможностей доставки и контроля качества.

За этим стоит «План Нирваны», возглавляемый Хэ Сяопэном.: за счет стандартизации и вертикальной интеграции основных компонентов, Xpeng снизил затраты на транспортное средство на 18%, имеется в виду G7, несмотря на 134 на мм длиннее колесная база, издержки 12,000 юаней меньше, чем у P7+ предыдущего поколения, достижение чрезвычайно сложного «скачка снижения затрат и повышения эффективности» на уровне производства.

Продажи Xpeng за первые шесть месяцев

По сравнению с погоней за одной-единственной моделью-блокбастером, Xpeng's реальное конкурентное преимущество постепенно растет внутри его организационной системы.. От контроль затрат в цепочке поставок до производственной итерации, от детальных пользовательских операций до финансовой ребалансировки, эти основополагающие возможности определяют, сможет ли бренд переход от тактических побед к стратегическим прорывам.

Точно так же, как более резкая складка на задней части G7 по сравнению с G6, это не просто эволюция дизайна — это отражает самоэволюция организационной системы Xpeng.

В этом бесконечный марафон умных электромобилей, только компании, которые постоянно создать «организационный ров» обладать способностью действительно выдержать циклы.