Kirish

The Xiaomi Yu7 sotilgan 200,000 atigi uch daqiqada bo'linmalar. The Tesla Model Y quietly hiked its price by 10,000 RMB a week later—while adding 31 km masofa. tomonidan 2025, the 200,000 RMB smart SUV market isn’t just about technology anymore; it’s a full-on battlefield of marketing, pricing strategy, computing power, and brand perception.

Right in the middle of this clash, the Xpeng G7 made a bold entrance. With a jaw-dropping starting price of 139,900 RMB and a massive 2,250 Hisoblash quvvatining TOPS, it disrupted the carefully balanced market. From a “specialist” to a “price disruptor,” Xpeng isn’t making a comeback—it’s launching a breakout move, hitting the core of what buyers really want: yuqori ko'rsatkich, aggressive pricing, and a brand that exudes cool confidence.

The three-way showdown is set, but the G7 isn’t just here to survive—it’s here to rewrite the rules of the game.

1.technological trump card

The Xpeng G7’s 800V architecture isn’t just a leap in specifications—it’s a systematic breakthrough in the four-dimensional game of ishlash, samaradorlik, tajriba, and cost.

At a time when the industry is still weighing the pros and cons between 400V and 800V systems, the G7 takes the lead with real-world results: 300 km of charge in just 12 daqiqa, proving that 5C ultra-fast charging is no longer a lab concept but a reality at scale. Uning 80.8 kWh battery pack delivers 702 km of CLTC range, consuming only 12.3 kVt/soat boshiga 100 km—just 0.1 kWh more than the Model Y AWD—effectively achieving double the fast-charging efficiency. This is the result of coordinated optimization between technology and engineering, validating the investment in a high-voltage platform.

At the core, the innovation lies in a systemic overhaul of the “three-electric” system. The G7 uses SiC (silicon carbide) power modules, pushing motor efficiency to 97.5%, a 2.3% improvement over the Model Y, reflecting a shift toward the “computing engine” of EVs.

On the battery management side, a AI-driven thermal control algorithm keeps range retention at 85% in -20°C cold, a 15% improvement over the previous generation, making it one of the few domestic EVs truly capable of extreme cold conditions.

Yet beneath this, practical realities remain: bilan third-party charger compatibility at only 78% va 800V infrastructure still limited, Xpeng will still need to rely on its own supercharging network in the short term to bridge the user experience gap.

(Image Source: Xpeng G7 car launch event)

If the electric drive represents raw power, then computing power is the XPeng G7’s ambition for “intelligent dominance.” It is equipped with three self-developed Turing chips: two dedicated to the XNGP full-domain autonomous driving system, and one paired with the Qualcomm 8295P to build the intelligent cockpit. Bu “compute separation” between cockpit and autonomous driving ensures redundancy while avoiding processing congestion.

Real-world testing shows that voice command response is just 700 ms, haqida three times faster than the industry mainstream. Of the vehicle’s total 2,250 TOPS hisoblash quvvati, ustida 1,500 TOPS are dedicated to real-time lidar point-cloud processing, making the G7 the only production car capable of “visual + lidar fusion” for all-weather operation. Biroq, this comes at a cost: the perception system consumes 45 V, 1.8 times Tesla’s HW4.0, forcing XPeng to redesign the thermal management system, sacrificing front trunk space in the process.

On the user experience side, XPeng emphasizes “stacked soft value.” Masalan, the AR-HUD has a 13.2-inch projection area, 2.4 times larger than traditional HUDs, displaying seven types of information—navigation, ADAS, speed, etc.—at a virtual distance of 7.5 metr, creating a “low-interference” driving view. Yet in strong sunlight, HUD brightness drops 30%, revealing the limitations of current optical hardware in extreme outdoor conditions.

The Xmart OS 5.0, powered by the 8295P, significantly improves voice interaction, erishish a 98.7% recognition rate, nearly error-free. But in noisy environments, latency rises to 300 ms, showing that performance still has room for improvement.

Chassis tuning is another area where the G7 differentiates itself. Its combination of hydraulic bushings + 200 m road preview favors comfort over extreme handling. Compared with the Model Y’s aluminum suspension designed for peak agility, the G7 reduces body motion by 40% over speed bumps at 60 km/soat, but shows 2.3° more body roll in high-speed corners. Bu “soft over hard” engineering approach suits family driving scenarios, sacrificing some aggressive driving performance. G7 isn’t trying to be an all-around champion—it aims to precisely address mainstream user pain points.

In comfort, XPeng continues its “scenario-first” strategy. The G7 seats use three-layer foam, o'lchash 50% softer than the Mercedes E-Class, though this comes at the cost of lateral support, reflecting a clear family-oriented design philosophy.

Xpeng G7 interior

The G7 achieves NVH (noise, vibration, and harshness) levels of just 64 db da 120 km/soat, 2 dB lower than the Model Y, a bilan rahmat thicker windshield va 32 acoustic package optimizations. Biroq, to save weight and control costs, XPeng removed the frameless doors. This omission has sparked debate among younger buyers who value aesthetics and refinement, highlighting the ongoing trade-off between experience and economy.

Looking at the overall technical composition, the XPeng G7 follows a “limited disruption + engineering compromise” strategiya: it invests heavily in core new-energy competencies such as the three-electric system, intelligent cockpit, and autonomous driving perception—aiming to overtake competitors in key areas. Yet in overall engineering, dizayn, and cost structure, it deliberately exercises restraint to avoid direct scale competition with Tesla and BYD.

This approach represents a “technology-driven value” middle path: it neither pursues extreme feature stacking nor engages in aggressive price wars. The question, ammo, is whether it can spark strong emotional attachment to the brand and product. When Xiaomi captures young buyers with unbeatable cost-performance, and Tesla locks in high-end customers with its brand prestige, the G7’s technological trump card must be memorable enough to define its breakthrough potential.

2.Precision pricing

The starting price of 195,800 RMB is not a simple “lower price for volume” tactic by XPeng, lekin a carefully calculated pricing game targeting consumer perception.

The G7 uses a “differentiated pricing” strategy to precisely exploit competitors’ blind spots: the Pro entry-level model hisoblanadi 53,900 RMB cheaper than the Tesla Model Y RWD, while adding ventilated and massaging seats plus a 20-speaker Dynaudio system—a 26% lower price bilan upgraded features.

The Long-Range Max version, combining the 800V yuqori voltli platforma bilan 702 km masofa, cleverly slots itself between the Model Y Standard Range (545 km) and Long Range (688 km), ishlatish technological advantages to create product scarcity.

The Ultra top version, da narxlanadi 225,800 RMB , strategically fits into the price gap between the Xiaomi YU7 Pro (215,900 RMB ) and Max version (235,900 RMB ), redefining the value benchmark for 300,000 RMB smart SUVs with just a 10,000 RMB difference.

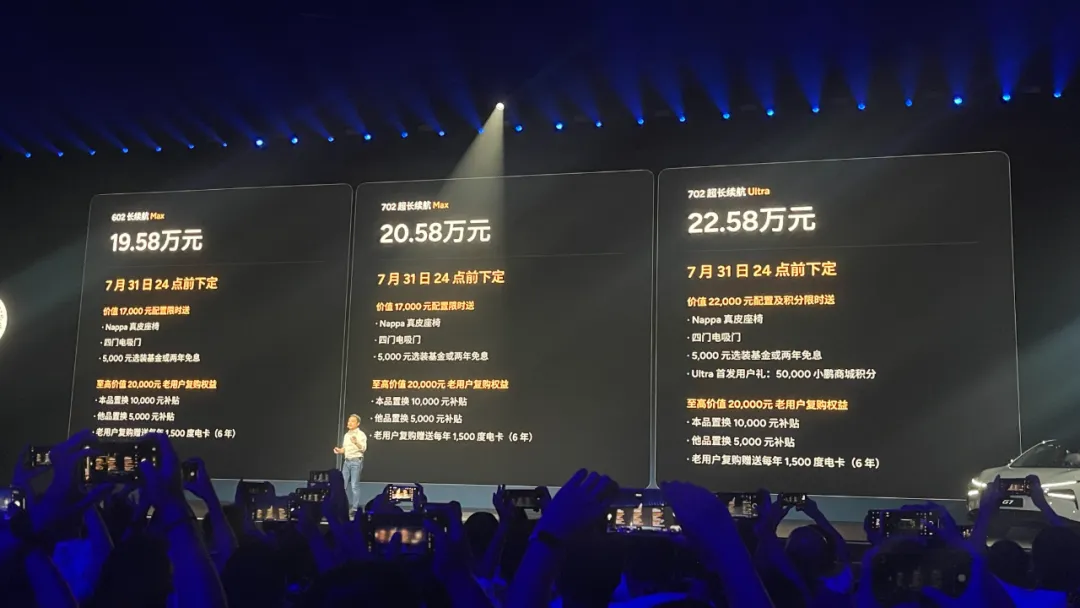

Xpeng G7 Price

Bu “price scissor” effect proves remarkably effective in real-world comparisons. Shu bilan birga Tesla Model Y AWD Long Range also offers 688 km, its price reaches 313,900 yuan, creating an 88,100 yuan gap compared with the G7 Ultra—equivalent to a premium of 128 yuan per kilometer of range.

Xuddi o'sha payt, the Xpeng g7 taklif qiladi 12 qo'shimcha funktsiyalar at a similar price point compared with the Model Y, shu jumladan AR-HUD, orqa o'rindiqni isitish, and fragrance system, while Tesla’s FSD (Full Self-Driving) requires an extra 64,000 yuan option—further diluting its price competitiveness. Bu “high-spec, low-price” strategy aims to redefine the value ceiling of mid-to-high-end smart EVs.

A deeper differentiation appears in autonomous driving capabilities. Tesla FSD in China still suffers from phantom braking (0.8 false triggers per 100 km) va rightward lane bias (15 cm lane deviation), whereas Xpeng’s XNGP highway NGP sees failure rates drop to 0.3 har bir 1,000 km va urban lane-change success rates reach 92%.

Xpeng’s forward-looking hardware layout, such as the Ultra version’s promise of future OTA upgrades supporting VLA/VLM large models, remains not yet live, creating some user anxiety over “futures-based selling.” This approach—securing technological high ground to bind users—carries both opportunity and risk.

Even space design demonstrates careful strategic play. tomonidan extending the body 134 mm, the G7 gains 819 L of rear trunk volume, 89 L more than the Model Y, but sacrifices the 35 L old bagaj. Xpeng is betting on family usage patterns—research shows post-95 family users use the rear trunk 17 times more frequently than the front—yet some critics question whether the “space magician” has become a “space waster.”

The battle on the cost side is equally precise. dan foydalanish “Nirvana Plan,” Xpeng reduced the number of body die-cast parts from 171 uchun 67, lowering manufacturing costs by 12,000 yuan, and replaced IGBT modules with silicon carbide (SiC) modules, cutting electric drive system material costs by 15%. Natijada, even though the G7 is 134 mm longer than the P7, uning starting price remains 24,000 yuan lower.

Biroq, to maintain a 20% gross margin, Xpeng turned to engineering plastics for door handles and interior trims—criticized as material downsizing, which somewhat diminishes the sense of premium quality.

Market feedback highlights the “sweet spots” and blind spots of this pricing tactic: on the first day of pre-sale, 23,000 buyurtmalar were secured, bilan Ultra top trim accounting for 70%, indicating strong consumer preference for advanced autonomous driving systems. By contrast, the Pro entry trim only accounted for 15%, showing that its low-spec advantage struggles to create strong perceived value. A more significant potential threat comes from the price-overlapping Xiaomi YU7, which has accumulated 289,000 buyurtmalar, 17% coming from Xpeng’s own user base, suggesting that the price war may quietly be turning into a user pool consumption battle.

In this tacit battlefield, Xpeng’s pricing strategy resembles a psychological game, attempting to break through brand barriers with configuration and earn future trust through technology delivery.

Yet the ultimate pricing power hisoblanadi not written in brochures—it is imprinted in the evolving value perception of the users themselves.

3.Ultimate moat

When June deliveries surpassed 34,611 birliklar, Xpeng’s capacity utilization neared the critical 95% threshold. The G7’s first-month production was capped at 8,000 birliklar—seemingly conservative, but in reality, it served as an extreme stress test of delivery and quality control capabilities.

Behind this lies the “Nirvana Plan” led by He Xiaopeng: through standardization and vertical integration of core components, Xpeng reduced per-vehicle costs by 18%, meaning the G7, qaramay a 134 mm longer wheelbase, xarajatlar 12,000 yuan less than the previous-generation P7+, achieving a remarkably challenging “cost reduction and efficiency leap” at the manufacturing level.

Xpeng’s sales in the first six months

Compared with chasing a single blockbuster model, Xpeng’s real competitive advantage is quietly growing within its organizational system. Kimdan supply chain cost control to manufacturing iteration, from granular user operations to financial rebalancing, these foundational capabilities determine whether a brand can transition from tactical wins to strategic breakthroughs.

Just like the sharper crease on the G7’s rear compared with the G6, this isn’t merely a design evolution—it reflects the self-evolution of Xpeng’s organizational system.

In this never-ending smart EV marathon, only companies that continuously forge an “organizational moat” possess the ability to truly endure across cycles.